Proxy Season: The Next Season of Succession?

We read proxies. And 10-K’s. We generally are not a fan of floating assets. We are generally not a fan of voting controlled public companies.

We read proxies. And 10-K’s. We generally are not a fan of floating assets. We are generally not a fan of voting controlled public companies.

Alex Karp, CEO of Palantir on CNBC this week: “I love burning the short sellers. Almost nothing makes a human happier than taking the lines

From a Mystery Q4 Earnings Call: I would also like to spend some time this morning reiterating and elaborating on XXX capital allocation priorities. First, our

Yes, it is easy to see how “older and crankier” develops when the nouveau twitter gushes over a Buffet aphorism that was seemingly revelatory in…1986?

Stop and Buy This Book: The Counting House by Gary Sernovitz

Liberty Trip filed to both “delist” to the pink sheets and move incorporation from Delaware to Nevada.

If your goal is to “pay attention to detail” and try to put some meat next to the headline potatoes, then Rob consistently presents logical

Yes, I broke my “Don’t do Podcast” rule from the enlightened height of our own self-interest. And it’s a classic example of the world in

We plucked this from a recent RFP we have seen for Smallcap Investing. First off, all hail the idea that someone is actually allocating money

The coast seems a little clear, Monster Truck Rain excepted. Since I dread writing this time of year from the standpoint of “predictions for any

Almost a year ago to date, financial markets had a mini freeze over some high profile examples of “liquidity issues” in the banking sector. Our

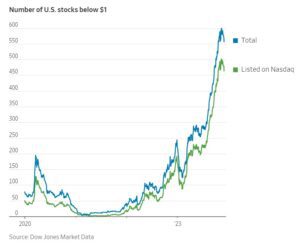

Last week the US Securities and Exchange Commission issued final rules for special purpose acquisition companies (Spacs). IN 2024! Final Rule Special Purpose Acquisition Companies,

Buffett was basically saying to Wall Street firms: “Even if you hire 100 brilliant Ph.D.s to run your models, no sensible estimate will emerge.” These

Full kudos on the young man who came up with this scheme. But if there ever was an idea that is ripe for abuse it

Statement Dissenting from Approval of Proposed Rule Changes to List and Trade Spot Bitcoin Exchange-Traded Products

It doesn’t matter whether company size is measured as assets, market value, sales, revenue, or number of employees — bigger firms pay more … way more.

The Verdad people do interesting work. That they tend to conclude with our internal bias towards toward small and value makes them even more fascinating.

”But what if you found out that key data underlying that breakthrough were actually wrong?” Academic research is fun-ish. A problem with making money from

The idea of regulation and the establishment of a legitimate exchange is to ensure that phony and fraudulent ideas DON’T go public in the first place.

Let’s be clear. Investing money is really about one of at least three things: structuring a pool of capital to meet stated goals, simply making

A sneaky little cull from the Financial Times this week on the world of Private Credit. Some in long pants might recall the former Citi CEO calling the top in 2007.

This is the FINRA proposal allowing investment managers to include specific return targets when raising money from “qualified” pools of money. If I knew I

We bought our Mutual Fund for $1 when we started Cove Street. It might have been overvalued on an NPV weighted for back-office commitment. This

The good folks at Verdad do quantitative work that exceeds our personal time commitment to the quantitative. So they are part of our read widely